Advertisement

-

Published Date

April 29, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

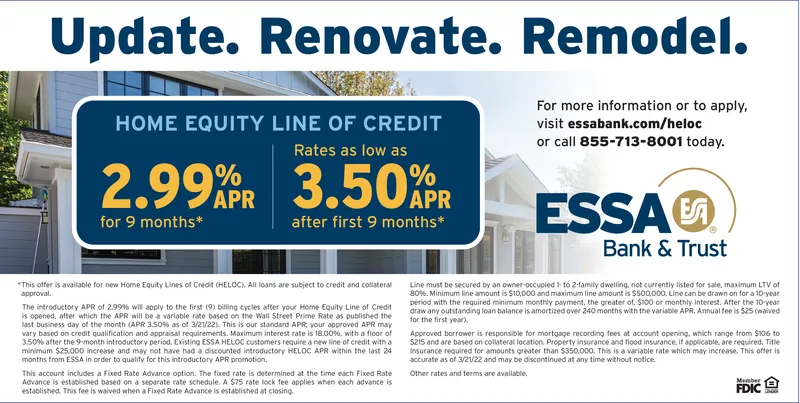

Update. Renovate. Remodel. HOME EQUITY LINE OF CREDIT Rates as low as For more information or to apply, visit essabank.com/heloc or call 855-713-8001 today. 2.99%R 3.50% PR ESSA for 9 months* after first 9 months* Bank & Trust *This offer is available for new Home Equity Lines of Credit (HELOC). All loans are subject to credit and collateral approval. Line must be secured by an owner-occupied 1- to 2-family dwelling, not currently listed for sale, maximum LTV of 80%. Minimum line amount is $10,000 and maximum line amount is $500,000. Line can be drawn on for a 10-year period with the required minimum monthly payment, the greater of, $100 or monthly interest. After the 10-year draw any outstanding loan balance is amortized over 240 months with the variable APR. Annual fee is $25 (waived for the first year). The introductory APR of 2.99% will apply to the first (9) billing cycles after your Home Equity Line of Credit is opened, after which the APR will be a variable rate based on the Wall Street Prime Rate as published the last business day of the month (APR 3.50% as of 3/21/22). This is our standard APR, your approved APR may vary based on credit qualification and appraisal requirements. Maximum interest rate is 18.00%, with a floor of 3.50% after the 9-month introductory period. Existing ESSA HELOC customers require a new line of credit with a minimum $25,000 increase and may not have had a discounted introductory HELOC APR within the last 24 months from ESSA in order to qualify for this introductory APR promotion. Approved borrower is responsible for mortgage recording fees at account opening, which range from $106 to $215 and are based on collateral location. Property insurance and flood insurance, if applicable, are required. Title Insurance required for amounts greater than $350,000. This is a variable rate which may increase. This offer is accurate as of 3/21/22 and may be discontinued at any time without notice. Other rates and terms are available. This account includes a Fixed Rate Advance option. The fixed rate is determined at the time each Fixed Rate Advance is established based on a separate rate schedule. A $75 rate lock fee applies when each advance is established. This fee is waived when a Fixed Rate Advance is established at closing. Member FDIC Dok Update . Renovate . Remodel . HOME EQUITY LINE OF CREDIT Rates as low as For more information or to apply , visit essabank.com/heloc or call 855-713-8001 today . 2.99 % R 3.50 % PR ESSA for 9 months * after first 9 months * Bank & Trust * This offer is available for new Home Equity Lines of Credit ( HELOC ) . All loans are subject to credit and collateral approval . Line must be secured by an owner - occupied 1- to 2 - family dwelling , not currently listed for sale , maximum LTV of 80 % . Minimum line amount is $ 10,000 and maximum line amount is $ 500,000 . Line can be drawn on for a 10 - year period with the required minimum monthly payment , the greater of , $ 100 or monthly interest . After the 10 - year draw any outstanding loan balance is amortized over 240 months with the variable APR . Annual fee is $ 25 ( waived for the first year ) . The introductory APR of 2.99 % will apply to the first ( 9 ) billing cycles after your Home Equity Line of Credit is opened , after which the APR will be a variable rate based on the Wall Street Prime Rate as published the last business day of the month ( APR 3.50 % as of 3/21/22 ) . This is our standard APR , your approved APR may vary based on credit qualification and appraisal requirements . Maximum interest rate is 18.00 % , with a floor of 3.50 % after the 9 - month introductory period . Existing ESSA HELOC customers require a new line of credit with a minimum $ 25,000 increase and may not have had a discounted introductory HELOC APR within the last 24 months from ESSA in order to qualify for this introductory APR promotion . Approved borrower is responsible for mortgage recording fees at account opening , which range from $ 106 to $ 215 and are based on collateral location . Property insurance and flood insurance , if applicable , are required . Title Insurance required for amounts greater than $ 350,000 . This is a variable rate which may increase . This offer is accurate as of 3/21/22 and may be discontinued at any time without notice . Other rates and terms are available . This account includes a Fixed Rate Advance option . The fixed rate is determined at the time each Fixed Rate Advance is established based on a separate rate schedule . A $ 75 rate lock fee applies when each advance is established . This fee is waived when a Fixed Rate Advance is established at closing . Member FDIC Dok